Valuing the choice to care.

We campaign to give mothers the choice and confidence to care for their children at home.

Established over 30 years ago in the face of increasing pressure for mothers to return to work before either they or their children were ready, our aims remain much the same today.

Child Benefit Tax Charge made your family's life unfairly hard?

Child Benefit Tax Charge made your family's life unfairly hard?

Read on here to see what MAHM is doing to explain the Child Benefit tax penalty and how it should be changed.

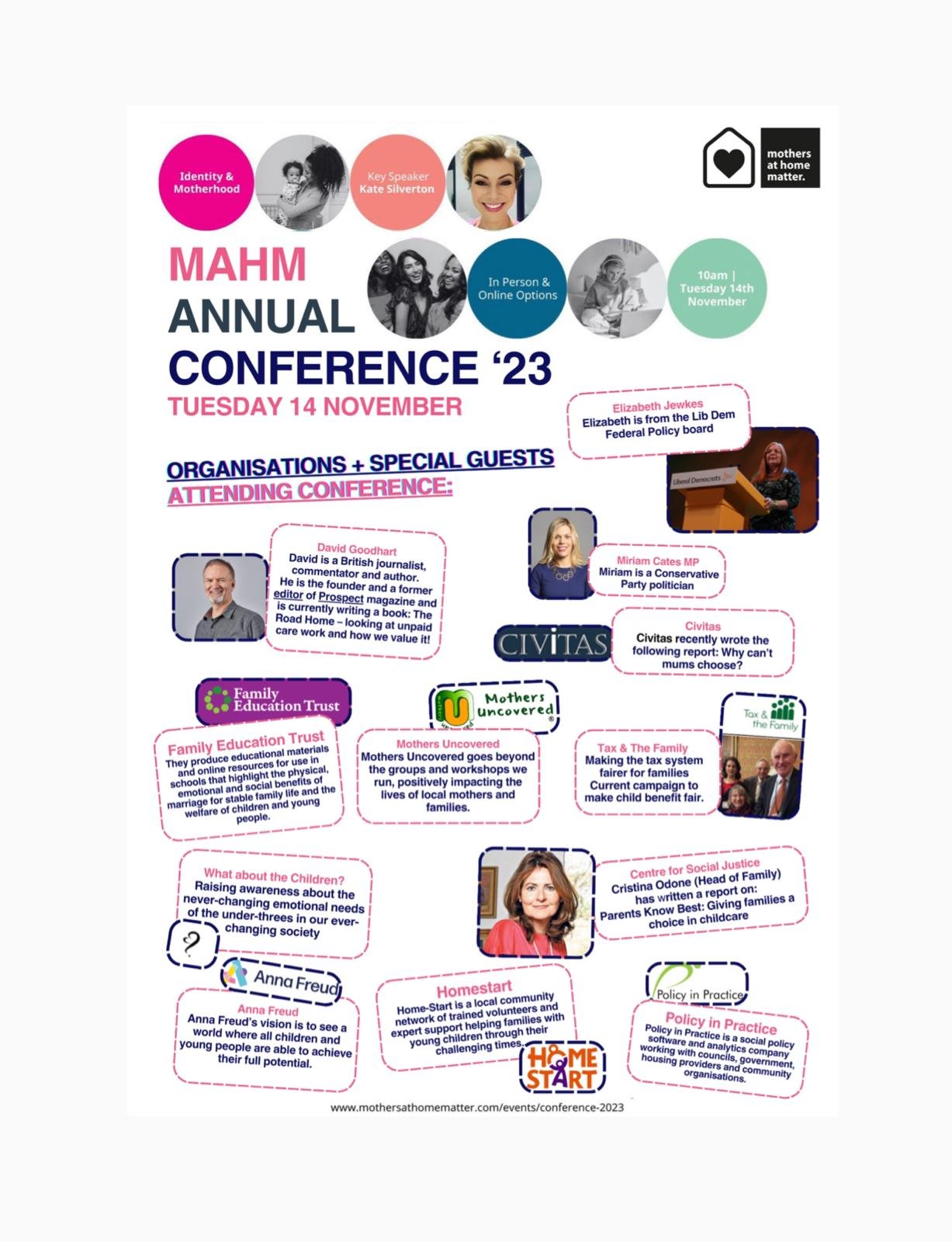

Annual Conference 2023

Our annual conference is always a highlight of our calendar and this year we were finally back in person, with an online option available too!

Kate Silverton, Liz Yeboah and others helped us explore the importance of mothers in society and in the development of children.

Recordings are provided to all delegates after the event.

Mothers at Home Matter. Psychologically their support means a lot; it makes you more confident in saying “I’m a stay at home mum and these are the reasons.”

— Citra, Mother at Home

Being a stay at home mother is not valued in today’s society.

One freedom the average mother no longer has is to choose to be at home to care for her children. Successive government policies have stacked the economic system against staying at home whilst a political and social elite have devalued the role and importance of care in the home.

Yet the reasons for making this choice – care of our children, our community, our elderly have not gone away. Rather the reverse. There seems a critical need for ‘care’ as we see rises in loneliness, depression and mental illness.

MAHM also recognises the work of fathers at home undertaking the day to day caring role. Many of our campaign aims, such as fiscal fairness for single-earner families and the importance of valuing ‘time spent caring’ apply to fathers just as much as mothers.

Latest news.

Explore.

Best kept secret.

Is it really such an alarming idea that a mother may harbour a desire to care for her own infant or young child? Here is our response to The Sunday Times.

Local groups.

Our local groups are lead by members volunteers to support mums in their vital role of raising children. Find out how you can benefit from this support.

Follow us on Instagram.

Your views.

Our mothers share their views on mothering, society’s attitudes, values, and economic justice.

Do get in touch with us or send us a 20-30 second video clip of your experience for our new campaign ‘Changing the Conversation’.

Podcasts.

Mothers Matter Podcast

Podcast episodes about mothers and the children who love them.

BBC Analysis Podcast

Episode: The Early Years Miracle? The Government spends billions on free early years childcare but is it a good thing for children, their parents and society? MAHM was invited to discuss.

Get in touch.

We would love to hear your views. The Mothers At Home Matter team members are volunteers but hope to respond quickly to your message.